Keeping you updated on your client’s application

You might remember a little while ago that we explained a bit more about the application status ‘in underwriting’ and what that meant in practice.

In this edition we’re taking things a step further to shine a light on applications where we need additional information, how we go about obtaining that and what happens if we need a GP report.

It’s good to talk

Wherever possible our Underwriters will attempt an outbound call to your client before requesting medical evidence so making sure we have an up-to-date mobile number for your client is super important.

Calling your client means we can have a more rounded conversation about their medical disclosures and often means we can make a decision there and then.

If we decide we still need a GP report, it also means we can provide a bit of positioning - so your client understands why we need it and what happens next.

When is ‘In Underwriting’ not in underwriting?

During this time the status in your tracking overview for the application will continue to show as ‘In Underwriting’ pending receipt of the medical information needed to assess the application. This doesn’t mean nothing’s happening or that we’ve not completed the initial assessment (perish the thought!) it simply means we’re awaiting the extra medical information we’ve requested to make a decision around the terms we can offer.

Chasing made simple

We know that shortening the application to issue timescale is critical to ensuring your client gets the cover they need when they need it, so we’ve created a series of tried and tested chase protocols designed to secure prompt return of the GP report.

In practice this means we’ll typically chase your client’s surgery as standard at days 9, 14 and 19. If we’ve still not received the information needed at that point we’ll continue to chase again around day 30 and 60. In between we’ll keep you and your client updated via a combination of updates in your portal and emails, so be sure to keep an eye out and make sure you have your alert preferences enabled.

Making sure you’re getting the updates you need

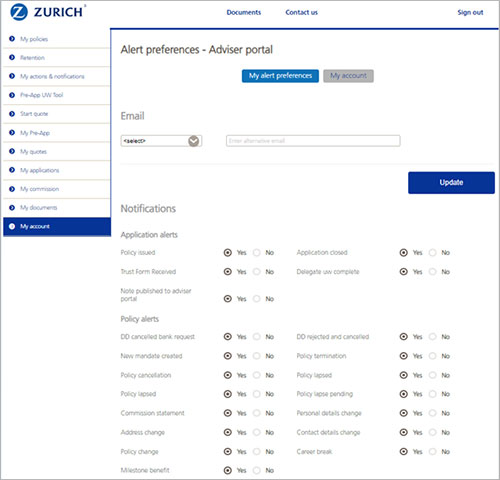

It’s always worth checking your alert preferences within your adviser portal, so you can be confident you’re receiving the updates you need on the topics you want.

You can do this by simply navigating to ‘My Account’ from the menu in your portal and checking alerts and notifications are enabled for both application and policy updates.

If you want to make any changes or add an alternative email address, remember to click the ‘update’ button to save them before exiting.

Everything you need, so you’re always in control

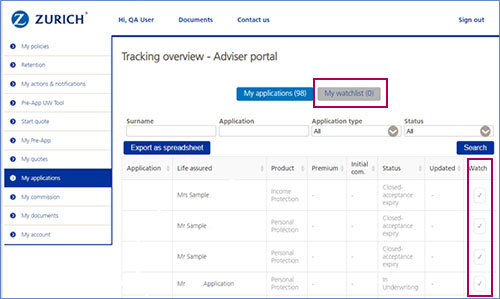

Once you’ve checked your alert preferences the next step to make things even easier is to add the applications you want to keep track of to your watchlist by simply ticking the ‘watch’ option.

When you’ve done that you’ll be able to see your very own tightly curated list of cases to keep tabs on by simply clicking on the ‘My Watchlist’ option in your tracking overview. This saves you having to scroll through all your applications to find the one you want, meaning everything you need is easily to hand.

All the information you need, all in one place

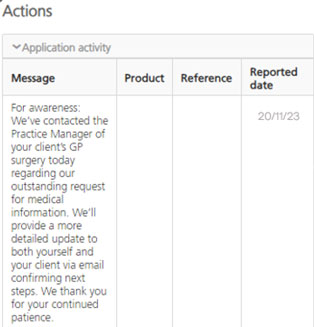

Once you’ve selected the application you’re after you can scroll down to the ‘actions’ section and view the application activity by simply clicking on the drop down.

This will show you any notes published from our team, along with any evidence items which might be outstanding to enable our underwriters to make a decision.

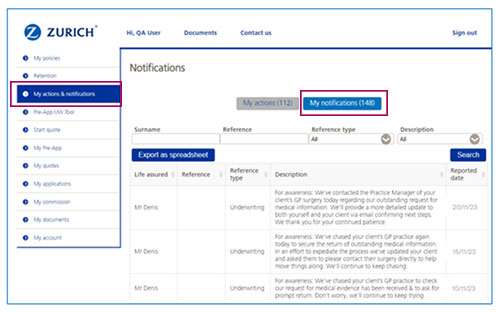

You can also view this information from the ‘My actions & notifications’ section of your adviser portal by simply clicking on ‘My notifications’.

We use this section of the portal to let you know of progress on your applications including any GP chasing activity, so consider this your ‘go to’ hub for information, actions, and updates.

Support crafted for you

We’re committed to making it easy for you to do business with us, so if there’s any support you need to help make the most of our proposition, don’t forget to reach out to your Protection Consultant.

If you’re new to Zurich or want to learn more about how we can help you grow your business, our team of protection experts are on hand to help.

Email us at contactus@uk.zurich.com

Sign up to our advice matters newsletter

Featured articles