Our policies are designed for customers who are resident in the United Kingdom.

The policyholder and life assured must be deemed permanent UK residents at the time the policy starts.

Occupation

The occupation is required for all applications, with some products requiring additional information due to the nature of the cover provided.

Life and critical illness

For life and critical illness the occupation almost always has no impact on the final terms. Some high risk occupations could attract a rating or an exclusion, examples of these include:

- Oil/gas exploration

- Armed forces

- Height work

- Mining or quarrying

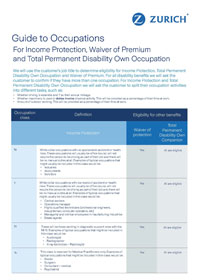

Income protection

For income protection the occupation is key to the assessment, as the product pays a benefit to the client if they are unable to work due to injury or illness. In order to provide a fair and accurate assessment we will ask for additional information including whether there any:

- Hazardous duties

- Driving as part of the occupation including annual mileage

- Manual work including frequency and extent

- Site work including frequency and extent

- Other occupations

HM forces

All clients will be asked whether they are a member of the armed forces and if so, the nature of their duties. Terms will depend on their duties and potential for deployment. If we cannot offer standard terms, the client could be given a temporary rating on life cover or an exclusion on critical illness. The more higher risk roles, such as Special Forces and bomb disposal, will unfortunately not be offered any cover.

We also do not offer income protection, waiver of premium or total permanent disability (TPD) for members of the armed forces.

Zurich Learning Hub

Your flexible learning hub — offering on-demand resources, bite-sized videos, interactive sessions, and expert insights to help you grow, your way.

Useful links

Claims

Visit our claims page for information on how to claim and up to date claims statistics.

Zurich Support Services

An independent team of counsellors, advisers and legal experts are there for your client and their family.

Large case underwriting team

A bespoke service for high value applications or large case underwriting.