An inclusive approach to underwriting

At Zurich, our goal is to create an application process that is fast and straightforward for both our customers and partners. We believe each customer deserves fair and accurate terms that are tailored to their personal circumstances and needs.

Thanks to our advanced point of sale underwriting system and highly skilled underwriters, over two thirds of clients using our interactive application process receive an immediate automated decision and over 90% receive an offer of terms on their application. These figures are based on submitted applications between January and June 2022.

Our underwriters have years of experience and can provide you and your clients with all the support you need. And to ensure we’re always up to speed with the ever changing world of medicine and protection products, we are constantly enhancing our underwriting service and point-of-sale underwriting system.

Medical conditions

Information we might need about different medical conditions and the terms we could offer.

Evidence types

Understand different evidence types that we may ask for including reports, examinations and questionnaires.

Lifestyle

How smoking or drinking alcohol can affect the cover offered.

Travel and pursuits

We appreciate that a UK resident may travel or even reside abroad during the life of the policy. We assess this risk during the application process for future travel and pursuits.

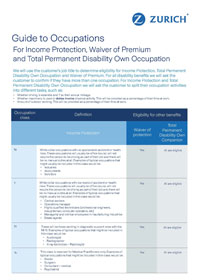

Occupation and residency

Understand our residency requirements and cover based on your job and military status.

Making underwriting easier

We know how important it is that the underwriting experience is as efficient and easy as possible. We’ve made a number of improvements to ensure that policies are not only accepted quicker, but are easily maintained.

We consistently review and improve our non-medical limits and application questions, making sure they’re competitive and in line with the latest medical developments.

Below are some of our features that allow for a professional underwriting experience with Zurich.

Easier to apply

- Delegated underwriting – allows your client to complete sensitive questions in the comfort of their own home, speeding up the process.

- Interactive underwriting rules – asks the relevant questions to drive more instant decisions.

Easier to amend

- Alternative terms – provides flexibility and choice in offering different outcomes to the client at the point of decision allowing budgets to be kept. This avoids the need to begin the application from the beginning, saving time for you and your client.

- Contractual change - multiple changes can be made, all controlled by you as an adviser on our new adviser portal. Medical evidence being valid for 12 months.

Easier to service

- Pre-application underwriting tool – this powerful 24/7 digital tool is fast, flexible, accurate and convenient. It’s updated whenever our underwriting rules change, so it’s always up to date.

- e-AMRA – allows your client to electronically provide their consent to obtain medical evidence, reducing the time to make a decision.

- i-GPR – embracing digital technology where General Practitioners will provide a digital medical report, speeding up the process.

- Mobile screening service with flexible appointments provided by Inuvi.

- Real time underwriting updates via adviser portal – greater control and understanding of where your client’s cases are, reducing time spent chasing for updates.

Zurich Learning Hub

Your flexible learning hub — offering on-demand resources, bite-sized videos, interactive sessions, and expert insights to help you grow, your way.

Useful links

Claims

Visit our claims page for information on how to claim and up to date claims statistics.

Zurich Support Services

An independent team of counsellors, advisers and legal experts are there for your client and their family.

Large case underwriting team

A bespoke service for high value applications or large case underwriting.