Ask the expert: ‘In underwriting’

You might remember recently we explained some of the different application statuses and what they mean when it comes to our Life Protection Platform in our article about referred outcomes.

In this article (by popular demand) we’ll delve a little deeper into the ‘In Underwriting’ bucket; what this means, where you can find more information about the application and what happens next.

Let’s take it from the top.

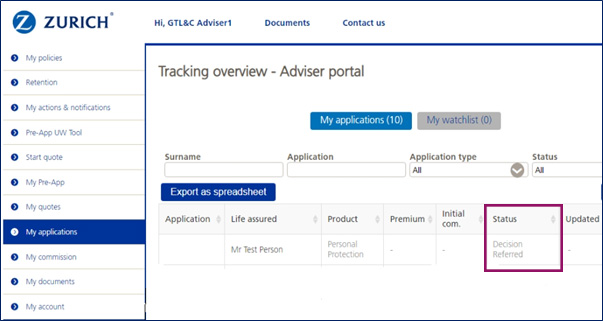

When an application is ‘In Underwriting’ you’ll see this shown in the ‘My Applications’ section of your adviser portal in your ‘Tracking overview’ shown below:

The status ‘In Underwriting’ (shown above) means that the application has been submitted to our team of experts for assessment. There may be scenarios where in order to complete that assessment, we’ll need additional medical information – for example a GP report or Nurse medical examination. In these examples, the status will continue to show ‘In Underwriting’ until the point at which a decision is made.

Everything you need, so you’re always in control

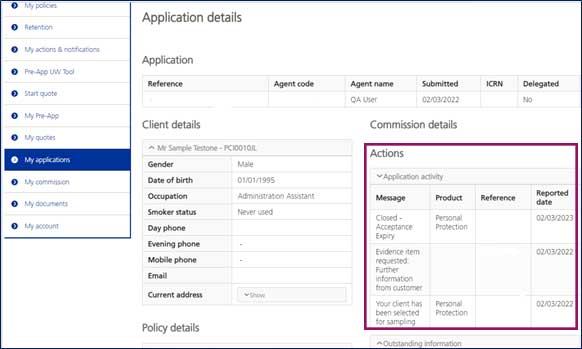

You can find out more about the status of a particular application including any activity or updates by simply selecting the application required from the list displayed.

From here you can scroll down to the ‘actions’ section of the application shown below and view the application activity by simply clicking on the drop down.

This will show you any notes published from our team, along with any evidence items which might be outstanding to enable our underwriters to make a decision.

You can also view this information from the ‘My actions & notifications’ section of your adviser portal by simply clicking on ‘My Notifications’.

We use this section of the portal to let you know of any additional requirements such as medical evidence which is needed to complete the assessment. We’ll also use it to publish any updates on the application from our Underwriters or Pipeline Management Team.

This includes information relating to chasing activity undertaken to GP surgeries following a request for medical information.

What happens next?

Once our underwriters have all the information they need to make a decision they’ll update the application and the status will change to reflect the decision outcome – for example ‘Accepted’, ‘Revised Terms’, ‘Deferred’ or ‘Declined’. You’ll receive a notification in your portal to let you know.

Need some help with a particular aspect of our journey?

Reach out to your Protection Consultant and we’ll be happy to help with future articles and webinars designed to give you the know-how you need to make it even easier to do business with us.

Sign up to our advice matters newsletter

Featured articles