Getting the most out of our online trust journey

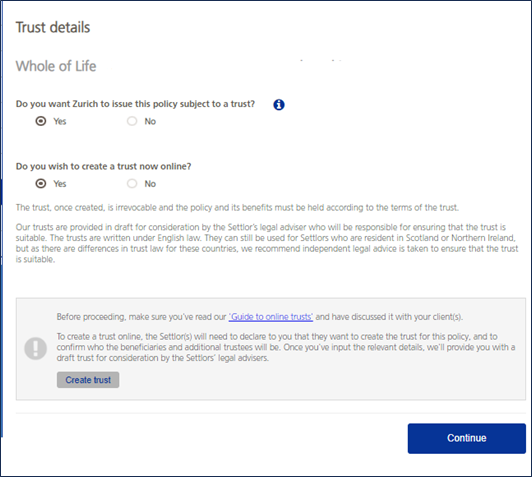

Placing a policy in trust at outset offers lots of benefits for customers but it’s one of the areas you often tell us you need a bit more help and guidance on when it comes to navigating these steps on the adviser portal.

To help make things a little easier, follow these straightforward steps and make placing your customer’s policy in trust a breeze.

- If your application generates a referral it’s best practice to wait until after an underwriting decision is made before attempting to complete the trust. If you retrieve an application while it is ‘referred’, the screen will show online trust is not available. This will reappear once a decision has been made.

- This is especially important on joint life applications because if one of the lives assured is subsequently declined, this could change the trust arrangements, so getting that certainty is key.

- Once a decision is made, we’ll let you know via an update in your portal. You can then retrieve the application and progress it through to issue and place the policy in trust.

With our online trusts, your customer simply needs to specify who they want to include as beneficiaries and any additional trustees.

We’ll then create a pre-filled trust form in draft format. Once you’ve completed the trust screens, the trust request will be held as part of the application and the policy issued subject to the trust. There’s no need for your customers to physically sign it.

If your customer decides to place their policy in trust, we’ll ask them for some additional information to enable us to set this up, including:

- Settlor benefits (if they want to include these in the trust or not)

- Trustee details (including the option to add up to 3 additional trustees online, you can choose to add more using a paper trust option)

- Beneficiary details – this includes the requirement to specify the share each beneficiary will receive as a %. The total of which must add up to 100%

Once all the relevant information has been entered simply click ‘continue’.

From here you’ll be able to download a draft copy of the trust, along with a copy of the ‘Guide to being a Trustee’.

If you’ve got any questions relating to tax, trusts or any other product related questions, you can contact our highly experienced team of technical experts using the details below:

Technical team

Tax, trust and product related pre-sale enquiries across the Life Protection Platform, encompassing personal and business protection.

Our telephone opening hours are: 10:00 – 12:00 and 2:00 – 5:00

Sign up to our advice matters newsletter

Featured articles