Ask our Experts: Getting to grips with alternative terms

A little bit of know-how can make a big difference when it comes to finding your way around our Life Protection Platform.

In this series we’ll be uncovering some of those lesser-known features, ‘need to know’ navigation and useful tips that make it easier to do business with us. This time around we’re shining a spotlight on alternative terms following a decision outcome.

Let’s break it down in just a couple of steps:

Step 1

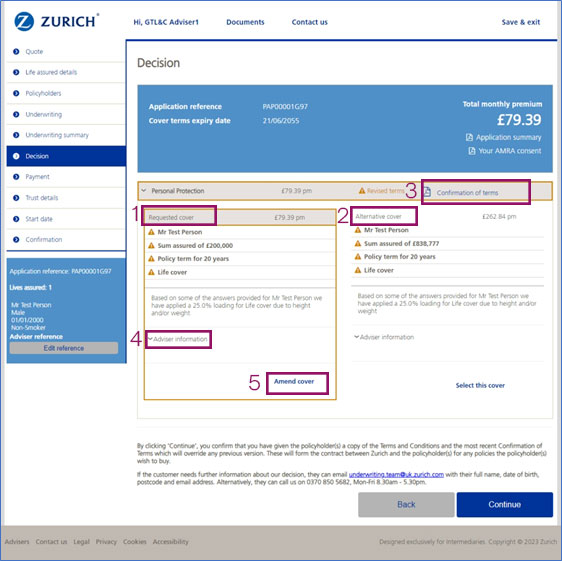

If revised terms are offered, where possible you’ll be presented with two options;

- One based on the original sum assured applied for with a revised premium following completion of the underwriting questions. This will be shown on the left-hand side of the decision page, titled ‘requested cover’.

- The second, shown on the right-hand side, titled ‘alternative cover’, will show a revised sum assured based as closely as possible, on the original premium quoted.

This is designed to provide you with an ‘at a glance’ set of options, whilst retaining the flexibility to allow you to amend these further to meet your clients needs and cost versus cover considerations. It also avoids the need to start the application again from scratch, saving you and your client valuable time and effort.

From here you can either elect to ‘amend’ the requested cover or choose to ‘select this cover’ for the alternative terms offer.

We’ll bring this to life below with a couple of visuals.

- The option on the left-hand side shows the originally requested cover, sum assured and term applied for with the revised premium, post underwriting.

- The option on the right-hand side shows the ‘alternative cover’ based as closely as possible to the original premium quoted.

- Terms will automatically appear for the requested cover in the ‘confirmation of terms’ section within the header on the decision screen. If you select the alternative cover, the confirmation of terms will update according.

- To reduce the sum assured, term, change the commission basis or remove optional covers click on the ‘amend cover’ option indicated.

- Clicking on the collapsible ‘Adviser Information’ drop down provides an explanation of the commission applicable.

Step 2 : Adjusting the sum assured, term and commission

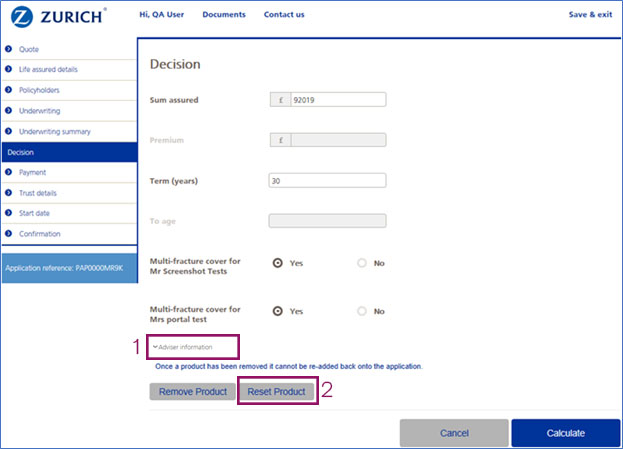

From this screen you can elect to reduce the sum assured or term of the policy, as well as adding or removing additional benefits. It’s not possible to increase the sum assured or term beyond the level originally underwritten at this point, without going back to ‘quote’ stage and re-underwriting the application.

- Clicking on the ‘adviser information’ option allows you to change the commission style and the amount you choose to take.

- Selecting the ‘reset product’ button on this screen will revert the application back to the original amount it was underwritten at & on which the decision was made. This will navigate you back to the decision page to view the original terms. It is good practice to do this after each amendment to the term or sum assured if you are running multiple premium scenarios for your client(s).

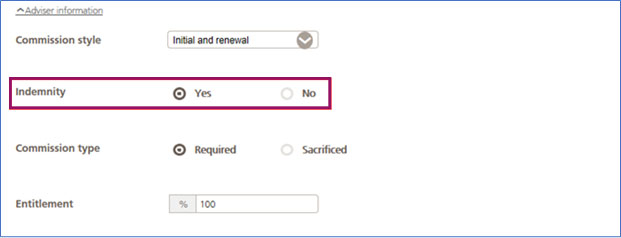

Consistent with the market, indemnity commission is not available on ‘own life’ policies.

We’ve updated our on screen messaging to explain this, including what we define as ‘own life’ for the avoidance of doubt.

In this section you can also choose to adjust the type, style and entitlement of commission you take.

Modelling different options

We know flexibility is key so let’s look at another scenario.

In this case we’ll assume you originally obtained an underwritten decision based on a sum assured of £100,00.

You decide to reduce this to £80,000 following the steps above and obtain a revised offer.

If you subsequently want to re-quote on £90,000 for example, simply select ‘amend cover’ again as shown in step 1.

When you progress to step 2 – make sure to click on the ‘reset product’ option first. This will revert the application back to the original £100,000 after which you can proceed to reduce this to £90,000 and obtain an updated price.

Viewing the confirmation of terms on the alternative cover option

To view the confirmation of terms on the alternative offer simply ‘select this cover’ as shown in step 1. This will then enable you to view the confirmation of terms document, visible in the top right-hand side of your screen.

Clicking ‘continue’ at this point will load this offer, so we’d recommend only doing so if you genuinely want to proceed on the basis of the alternative offer outlined. This is because once selected, you’ll be unable to easily revert back to the requested terms, without going back through underwriting.

We’re all ears…

Helping you make the most of our platform so you can provide the best possible service to your clients is what we’re all about. So, if there’s something you’d like demystifying or you just need a bit of navigation expertise, please speak to your usual Zurich contact.

We’ll be happy to include some targeted know-how and tips on the topics that matter most to you in future editions or add these into our Webinar programme.

Sign up to our advice matters newsletter

Featured articles