Features designed around you

Sometimes you want the flexibility to allow your clients to complete underwriting questions in a way, and at a time, that works for them. This can be especially important if it’s sensitive medical information.

That’s where our ‘Delegate Underwriting’ feature can help.

Once you begin the underwriting questions, simply click on the ‘Delegate’ button from the blue left-hand sidebar to send the underwriting questions to the life assured. This allows your client to complete and return key medical information about their health and lifestyle in the privacy of their own home.

This can be particularly useful if your client needs to source information about their past medical history, ensuring more accurate disclosures and therefore, a more accurate underwriting outcome.

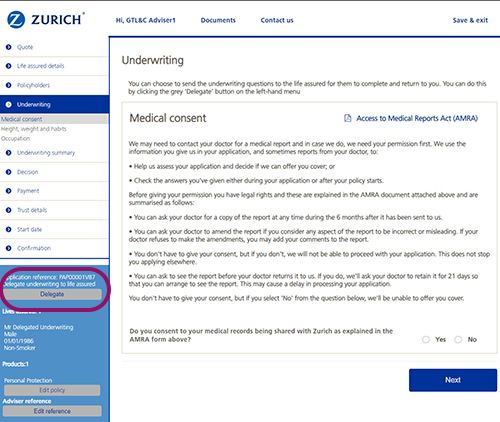

You’ll see this feature signposted on the Underwriting section of the online application when applying, just above the medical consent section.

We’ll step through this below or you can watch our handy ‘how to video’ by clicking here.

Step 1. To delegate the underwriting questions simply click on the ‘delegate’ button.

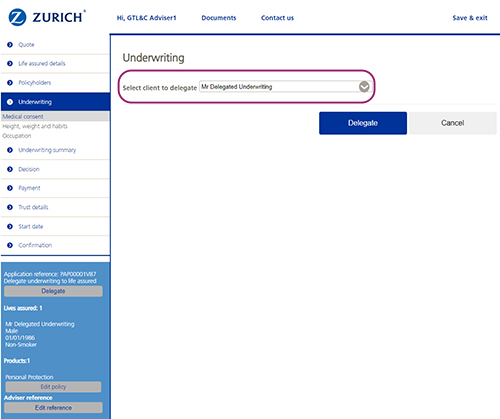

Step 2. Now select which life assured you’d like to delegate the underwriting questions to using the drop down option circled below.

Once you’ve done that, we’ll send the questions over to the life assured using the email address provided for them on the application.

As soon as you’ve delegated the underwriting to the life assured the ‘My Notifications’ section of your adviser portal will update to reflect this.

Once your client has completed the underwriting questions you’ll receive an email to let you know the application is ready to progress. You can then retrieve the application and complete the remaining steps required.

Still need convincing?

Check out what other advisers say about our delegated underwriting feature or take a look at our ‘how to’ video here.

"Simple quote and application system. Love the delegate underwriting option too."

"The ability to delegate the underwriting questions to the life assured makes the process quicker, easier & reduces our business risk"

Sign up to our advice matters newsletter

Featured articles